By 2035 Victoria will need 25 gigawatts of new renewable energy and storage capacity.

The SEC is contributing to this by investing to deliver 4.5 gigawatts in new renewable energy generation and storage. Our work will ensure Victorian households and businesses continue to have the power they need as we transition to renewable energy.

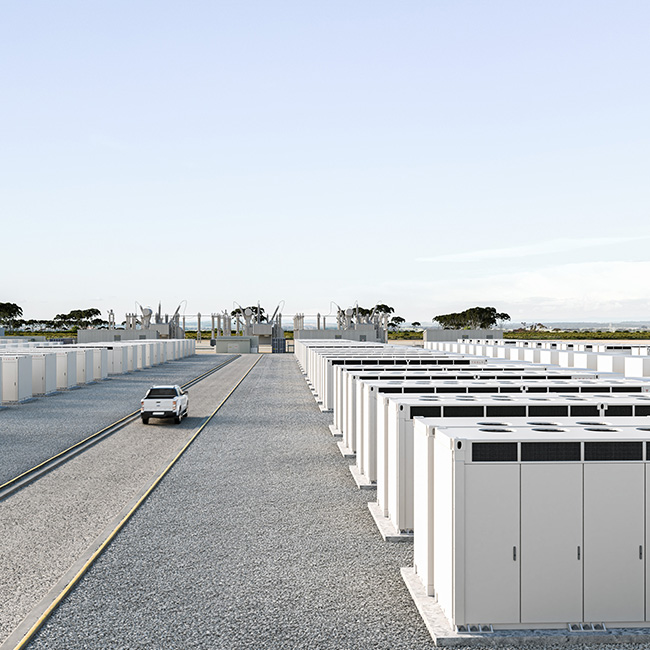

This includes working with the industry to invest in wind and solar electricity generation and energy storage.

By focusing our investments on opportunities such as storage, we can address critical system gaps and help catalyse investment in wind and solar to replace assets such as ageing coal-fired power stations.

We will leverage Victoria’s existing wind and solar projects (VRET 1 and 2 and Bulgana) to help the Victorian Government meet its pledge of using 100% renewable electricity across all its operations, facilities and services by 2025.

We are also seeking ways to provide competitive 100% renewable energy products to commercial and industrial customers so they can achieve their decarbonisation commitments.

Finally, we are exploring investment opportunities in new and emerging technologies that improve efficiency and will help Victoria maintain reliable and affordable energy long-term.